Each year, formally organized entities must make available an annual report of their prior year’s activity. In Canada, there are a relatively small number of organization that thar obligated to provide such a report.

Humanist Heritage Canada is not required to publish an annual report because we are not a public organization. However, we maintain an interest in documenting the activity of Canada’s humanist communities.

Centre For Inquiry Canada was founded in Toronto in 2009 and rapidly became one of Canada’s leading secular/humanist organizations. The organizations 2024 report was released via the CFIC website on March 9, 2025.

CFIC’s lead claim for the year appears to be that, “GLOBALLY AND ACROSS CANADA SECULARISM, SCIENCE AND HUMAN RIGHTS HAVE BEEN… UNDER ATTACK.” (all caps courtesy of CFIC). The report provide some description of how it has responded to the situation.

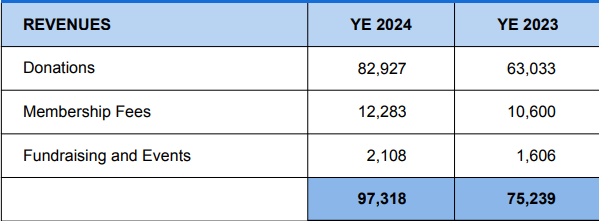

In addition to providing an annual report, CFIC makes available a statement of its financial position. This is a part of the organization’s responsibility as a registered charity. This information helps to reveal information about the organization’s scope and active membership.

Given that CFIC’s membership fees are $45 (individual) and $60 (family), we can determine that CFIC reported a membership of approximately 205-275 people for the year. The annual donation figures provide a much less precise measure of the organization’s scope as these revenues are typically skewed by a small number of large donors. In CFIC’s first years of operations, a single family foundation provided the primary sustenance of the organization.

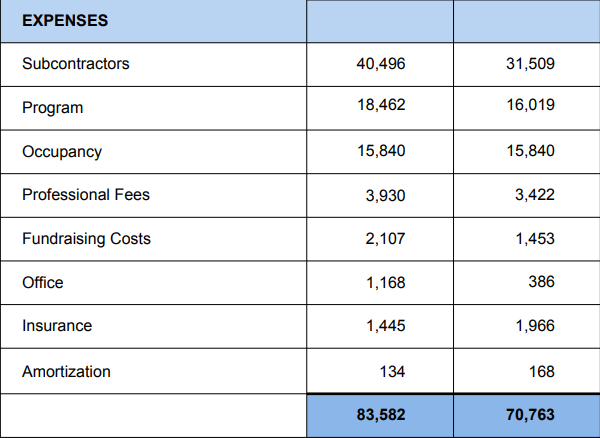

Of some reasonable concern is the distribution of the organization’s expenses as some 41.7% of the organization’s revenues appears to have been sent to “subcontractors”. The annual report does not make clear what the subcontractors did for the organization. Given that this line is the single largest in value for the organizations’ report and that it is more than double the “program” expenses, some additional transparency may be appropriate to explain what the expenses represent.

In a 2008 article, Mark Blumberg posted an article regarding the use of funds by charities, “Some people use the 80/20 rule because the Canadian disbursement quota (DQ) requires charities in most cases to spend 80% of the amount receipted by the charity in the previous year on charitable activities in the following year. The 80/20 rule is very misleading in terms of overhead as many charities receipt little of their donations and therefore can legally spend much less than 80% of their revenue in the previous year on the subsequent year’s activities and still be compliant with the disbursement quota. In fact, many charities could take in a lot, and spend nothing, and still be compliant with their disbursement quota obligations.”

Blumberg goes on cite Canada Revenue Agency guidance to assessing the activity of charitable organizations:

“The CRA has come up with a grid for evaluating fundraising expenses based on the percentage of “fundraising costs” to “fundraising revenue”. The evaluation grid provides:

Ratio of fundraising cost/fundraising revenue in fiscal period

- Rarely acceptable: more than 70% (charity nets less than 30%)

- Generally not acceptable: 50% to 70% (charity nets 30% to 50%)

- Potentially not acceptable: 35.1% to 49.9% (charity nets 50.1% to 64.9%)

- Generally acceptable: 20% to 35% (charity nets 65% to 80%)

- Acceptable: less than 20% (charity nets more than 80%)”

Given CFIC’s activity expressing concern regarding the “cost of religion in Canada’ which includes an examination of financial indicators of faith-based charities in Canada, it seems appropriate that CFIC’s financial report receive at least some public, independent third-party scrutiny.

Up For Discussion

If you’re interested in analyzing and discussing this issue, there are actions you can take. First, here at Humanist Heritage Canada (Humanist Freedoms), we are open to receiving your well-written articles.

Second, we encourage you to visit the New Enlightenment Project’s (NEP) Facebook page and discussion group.

Citations, References And Other Reading

- Featured Photo Courtesy of :

- https://www.canada.ca/en/revenue-agency/services/charities-giving/charities/operating-a-registered-charity/annual-spending-requirement-disbursement-quota/disbursement-quota-calculation.html

- https://centreforinquiry.ca/become-a-member-of-cfic/

- https://www.canadiancharitylaw.ca/blog/how_much_should_canadian_charity_spend_on_overhead/

- https://centreforinquiry.ca/wp-content/uploads/2021/04/CoR-charitable-tax-receipting-revised-may-6.pdf

By continuing to access, link to, or use this website and/or podcast, you accept the HumanistFreedoms.com and HumanistHeritageCanada.ca Terms of Service in full. If you disagree with the terms of service in whole or in part, you must not use the website, podcast or other material.

The views, opinions and analyses expressed in the articles on Humanist Freedoms are those of the contributor(s) and do not necessarily reflect the views or opinions of the publishers.